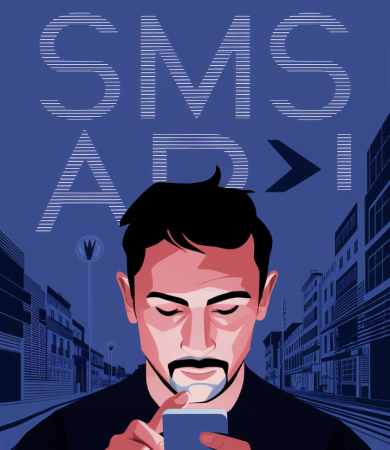

India is experiencing a fast-paced digital transformation, fueled by significant advancements in mobile technology and efforts aimed at improving financial inclusion. A major contributor to this change is the widespread adoption of mobile wallets, which have completely transformed the way people in India handle and interact with their finances. One of the most notable developments in this area is the integration of API-enabled bill payment systems, which have become a key feature of the mobile wallet ecosystem. These systems have greatly simplified the bill payment process, offering increased convenience and efficiency to millions of consumers across the country.

This blog takes an in-depth look at the growing role of mobile wallets in bill payments in India. It examines how APIs are integrated into these systems, allowing seamless connections between service providers and mobile wallet platforms. The blog also highlights the various benefits for consumers, such as ease of use and time savings, as well as advantages for service providers, including better customer engagement and streamlined operations. Additionally, it discusses the challenges encountered in the implementation and adoption of this technology, while also considering the future of mobile wallet-based bill payments in India.